Hyderabad: (PTI) Over 1,500 delegates from nearly 50 countries will take part in a three-day technology and bio-business convention on Asia that will get underway here. The event, BioAsia 2017, is a technology and bio- business convention of Asian nations on life sciences, pharmaceuticals and hea…

Start Up India

Digital lending firm Zen Lefin raises Rs 17 cr from IFMR

Bengaluru: Digital lending company for small business Zen Lefin, known by its trade name Capital Float, has raised Rs 17 crore from IFMR Capital Finance and its alternative investment fund by allotting nonconvertible debentures (NCDs), bringing the company’s total capital raised through the route…

Capital Float secures ₹17 cr funding from IFMR Capital through NCDs

Capital Float, a finance technology startup which helps SMEs secure capital online, has raised close to ₹17 crore in a round led bt IFMR Capital Finance and its alternative investment fund. Unlike others, this is not a private equity deal. The company has raised money by allotting Non-Convertible…

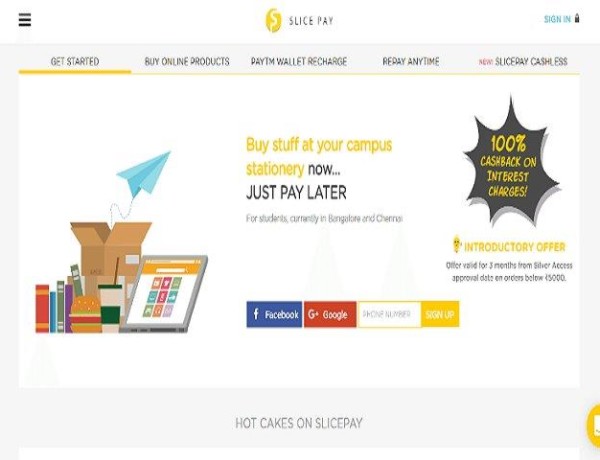

Fintech start-up SlicePay acquires P2P lending platform Trustio

SlicePay, a fintech startup that provides buy-now-pay-later kind of service to its users, has acquired a peer-to-peer lending company Trustio. The deal is said to be an equity deal and as a part of the acquisition, the founders of Trustio will be joining the core team at SlicePay. Launched in 201…

Stellaris hits first close for $100 mn fund

Mumbai: After a year of breaking away from Helion Venture Partners — one of the country’s oldest venture funds — Ritesh Banglani, Alok Goyal and Rahul Chowdhri have managed the first close of their $100 million (Rs 680 crore) maiden fund which will back domestic early-stage startups. Stella…

Start-ups, FDI to be exempt from new tax on unlisted firms

Allaying investor fears over levy of long-term capital gains tax on share transfer in unlisted companies, the government on February 3 said the move is only to target ‘khoka’ companies and ‘genuine investments’ in startups and through FDI will be exempt. Revenue Secretary …

Jaitley provides tax breaks to start-ups and SMEs, but their concerns remain

The Union Budget 2017 seeks to strengthen the push to a digital and cashless economy. It is good on intentions and takes baby steps towards a digital India, the move which was kick-started with the demonetisation drive. The Budget, which revolved around farmers, youth and affordable housing, also…

Budget 2017: A hit or a miss for entrepreneurship in India? Start-ups respond

The biggest day on India’s policy calendar had a slew of announcements directed at the middle class and the rural sector, but few that shone a spotlight on the burgeoning startup ecosystem in India. India’s payment industry, however, has much to cheer about with the proposed regulator…

Arun Jaitley’s Union Budget didn’t address key concerns of start-ups & SMEs

Budget 2017 has provided tax exemptions to small and medium scale enterprises (SMEs) and start-ups. SMEs got a drop of five per cent on the tax rate, which according to Finance Minister Arun Jaitley, would benefit 96 per cent of businesses. However, what it doesn’t do is to come up with an energi…

Budget 2017: Start-ups get more time to choose their 3-year tax holiday

No gain, without pain is the verdict from startups and investors on tax measures unveiled in the Budget. Income tax rebates for startups have been extended for three out of the first seven years since incorporation. The industry is cheering the move to allow startups -certified under the IT Act o…