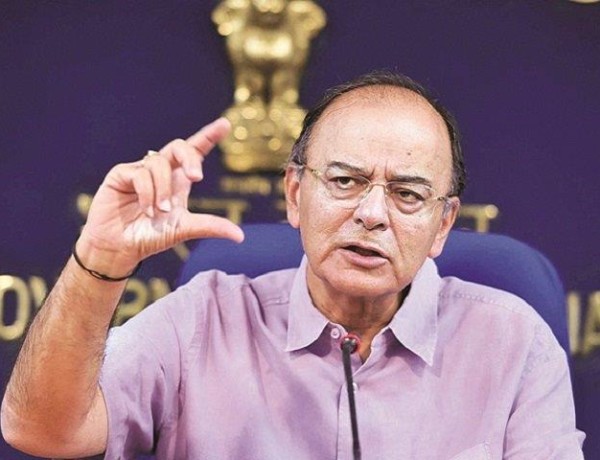

GST launch will take place exactly at midnight of June 30 and July 1 GST will be launched in the presence of President Pranab Mukherjee There will be a 1-hour program at the launch Finance Minister Arun Jaitley on June 20 shared the contours of the GST (Goods and Services tax) launch program on t…

Tag: Arun Jaitley

Delay in IT security clearance not to affect GST launch: Arun Jaitley

Finance Minister Arun Jaitley said GST rollout will not be impacted by any delay in security clearance to GST Network, the IT backbone provider for the new indirect tax system. “It (GSTN) is already functioning,” he told reporters here. Security clearance to GSTN is a “procedura…

GST Council gives relaxation of 2 months for filing of GST returns

India’s tryst with its most comprehensive indirect tax reform, the goods and services tax (GST), will begin on July 1. The GST Council, the apex decision body for the new tax, has stuck to the scheduled rollout. GST seeks to bundle state and central levies into one and create a seamless national …

Want job work on apparels also be brought under 5% GST rate: TEA

With almost all textile bodies hailing the GST rate for the industry, Tirupur Exporters Association has requested further reduction in the ‘job work on apparels’ sector. Thanking the GST Council for timely intervention for reduction of GST rate for job work in textiles, TEA President …

GST Impact: Small business owners feel jittery over e-way bill, sales tax rule

In a move to protect interest of small business owners from the government’s implementation of GST, industry owners have urged the government for relaxed procedures and revised policies. “India is a huge market out there, a sale of Rs 50,000 per consignment is not an occasional incide…

Rashesh Shah to lead biz delegation to South Korea for promoting Indo-Korean Economic Partnership

A high-powered FICCI business delegation led by Rashesh Shah, Senior Vice President, FICCI, and Chairman & CEO, Edelweiss Group, is accompanying Finance Minister Arun Jaitley to South Korea from 14-15 June 2017 to enhance the bilateral economic engagement and business co-operation between the…

Textile body hails revision of job work rates

Indian Texpreneurs Federation (ITF) hailed the revision of job work rates for textile, leather and gems and jewellery sectors to five per cent from 18 per cent announced earlier. In a statement, ITF Secratary, Prabhu Dhamodharan said that for the past one week, all associations from here were req…

GST Council forms 18 groups to sort out industry worries

The GST Council has set up 18 sectoral groups to interact with the sectors like telecom, banking and export and sort out their issues in a time-bound manner for a smooth transition to the new indirect tax regime. These sectoral working groups consist of senior officers from the Centre and states …

UN cites Indian start-up fund for govt policies on developing digital sector

The World Investment Report 2017: Investment and the Digital Economy, released by the UN Conference on Trade and Development (UNCTAD) cited the ‘India Aspiration Fund’ to say that government policies can actively support investment in local content and services and in the development …

Industry now gets 90 days to claim credit for GST transition stock

Traders and retailers can file declarations within 90 days claiming tax credit for transition stock after the GST rolls out from July 1. The draft transition rules for the Goods and Services Tax (GST) regime had pegged the time at 60 days. The transition rules approved by the GST Council provides…