Nearly 65 per cent of startup executives and founders believe that the Indian startups are in a technology bubble, while 18 per cent feel that the bubble was close to bursting soon, a study by venture debt and specialty lending business, InnoVen Capital, said. The India Startup Outlook Report 201…

Tag: fintech

Digital drive tilts hike scale in favour of fintech start-ups

New Delhi: Financial technologies and learning solutions are this appraisal season’s winning bets at startups in India, where last quarter’s currency swap and the government’s visible drive toward digital transactions may help dislodge marketplace unicorns as bulge-bracket paymasters. The reversa…

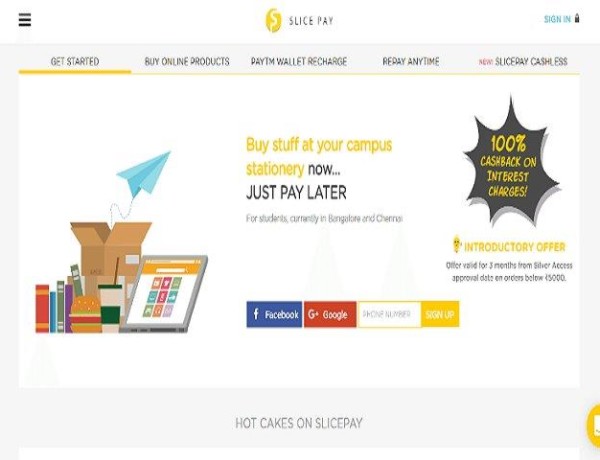

Fintech start-up SlicePay acquires P2P lending platform Trustio

SlicePay, a fintech startup that provides buy-now-pay-later kind of service to its users, has acquired a peer-to-peer lending company Trustio. The deal is said to be an equity deal and as a part of the acquisition, the founders of Trustio will be joining the core team at SlicePay. Launched in 201…

Union Budget 2017-18 will strengthen the economic muscle of the country: Pankaj Patel, President, FICCI

“It is directionally correct, fiscally prudent and strengthens the governance fabric of the nation” Commenting on the Union Budget 2017-18, Pankaj Patel, President, FICCI said “This budget would tremendously strengthen the economic muscle of the country. It is directionally correct, fiscally prud…

Budget 2017 needs to address structural changes: Yes Bank CEO

At a time when the economy is gathering momentum, the Budget will certainly be the most important opportunity to chart the future course for structural and institutional reforms. 2017 promises to be a year where we stand to reap the benefits of passage of key reforms such as GST and the Bankruptc…

Govt in talks with start-ups to push contactless payment

The government is in talks with technology providers to encourage the adoption of new cashless technologies such as contactless payments that use sound waves and near-field communication. “We are looking at a lot of new technologies that enable cashless transactions with less investment on infras…

Fintech start-ups can lead the way to India’s financial inclusion

India is changing into an effervescent ecosystem offering fintech lending start-ups a platform to potentially grow into billion-dollar unicorns. Although relatively young at present, the sector is escalating rapidly, fueled by the large innovation-driven start-up landscape, and responsive governm…

Digital Transformation enabling credit facilitation for the small borrower| Sameer Segal, Co-Founder & CEO, Artoo

Micro, Small and Medium Enterprises (MSMEs) is a heterogeneous segment, where 96% lack access to formal finance. They operate entirely in cash, resulting in an almost non-existent digital footprint. Most borrowers in this segment are first-time loan applicants with limited financial literacy. Lac…

Fintech co Rubique processes loans worth Rs 975 cr

Mumbai, December 28, 2016: Rounding up the year in style, Rubique, the one-stop online marketplace providing technology enabled end-to-end solutions to financing needs of individuals & SMEs has announced that it has processed more than Rs 975 crore worth of loans since its inception in Octobe…

Big setback for start-ups in India, investment plunge 44% in 2016: Study

Investments in start-ups declined significantly in volume (28%) and value (44%) in calender 2016. The deal sizes got smaller as angel and early-stage funding dominated and late stage funding took a backseat, said VCCEdge in its year-end analysis. In 2016, start-ups witnessed a 44.3% decline in in…