After launching comprehensive digital banking services for small and medium-sized enterprise (SME) clients on June 30, private sector lender HDFC Bank is now working on doing the same for its large corporate clients, country head – business banking — Aseem Dhru told. With the launch on June 30, t…

Tag: HDFC Bank

HDFC bank launches SME e-bank

HDFC Bank, the country’s second largest private sector lender, has launched a digital bank for its Small and Medium Enterprises (SME) customers. It aims to grow its market share in the hinterlands with this. “It takes away the hassle of physical availability of a relationship manager and makes ba…

SBI rolls out Rs. 200-cr start-up fund

State Bank of India seems to be setting great store by start-ups in the financial technology (FinTech) space. After starting an exclusive branch for start-ups in Bengaluru earlier this year, it has set up a Rs. 200-crore fund to provide assistance to them. SBI Chairman Arundhati Bhattacharya said…

Private banks keen to play venture capitalists to startups

Top private sector banks with deep reserves are now playing venture capitalists to startups at a time when startup valuations are sliding and angel investors have become more cautious than before. ICICI Bank , HDFC Bank and Axis Bank have formed separate lending teams to fund small startups, main…

Banks develop an appetite for start-ups

In a dimly lit auditorium, three groups were called on to the stage to polite applause. Electronic music, with the bassline turned up too high, reverbed through the speakers. A couple of them smiled as they held their award to the flashlight of two cameras. Orange, which was the hallmark colour o…

Car finance market is expected to grow at a CAGR of 13.5% from FY’2016 – FY’2020 | Ken Research

The pre-owned car finance market has emerged as one of the fastest growing market in the previous few years. The major players or the financiers in the Pre-Owned car finance market are banks and the NBFC’s wherein the major share has gone to the banks because of the underlying trust of the people…

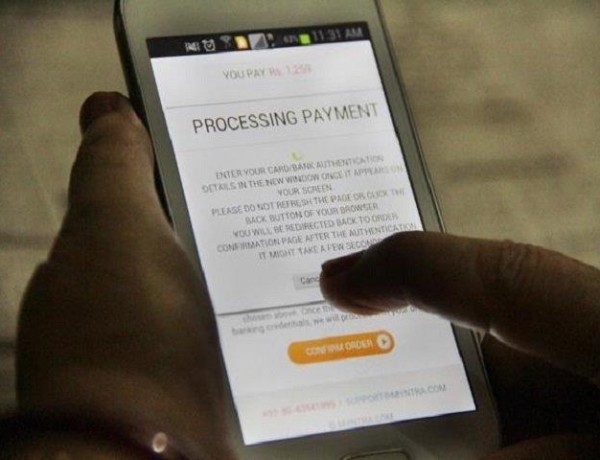

Mobile banking sees dramatic surge in India

The value of transactions concluded over smartphones surged in recent months as banks encouraged businesses to manage their finances using mobile phones and mobile usage among retail customers expanded rapidly. The value of mobile banking transactions jumped 46% to `49,029 crore in December from …

HDFC Bank launches dedicated product for start-ups

Country’s second largest private sector lender HDFC Bank launched a dedicated product for start-ups which will offer banking, payments and forex services. The product’s features include enhanced transaction limits with no minimum balance requirement for the first six months, customise…

HDFC Bank gets startups onboard to increase customer convenience

Very soon you might be able to make payments digitally at a retail outlet without any internet connection on your phone, get personalised banking options when you withdraw cash from an ATM, or even do phone banking over a chat session with a robot. India’s second largest private sector lend…

Snapdeal assists capital needs of 1,200 SMBs with Rs 300 crore

Snapdeal’s Capital Assist programme has reached out to 1,200 small and medium-sized enterprises across 300 cities in the country and disbursed loans of around Rs 300 crore till date. The e-tailer has tied up with 25 financial institutions under its Capital Assist programme, which includes HDFC Ba…