While funding in the HR-tech startup space plateaued this year after seeing its biggest peak in 2015, entrepreneurial and investor sentiment in the space has remained unscathed. As many as 65 new HR tech startups have emerged in India so far this year, according to startup research platform Tracx…

Tag: IPO

Sapphire Ventures closes $1 billion fund to back startups

Venture capital firm Sapphire Ventures has closed a $1 billion fund to invest in technology startups, becoming the latest investment firm to join a record-breaking clip of venture fundraising. Sapphire Ventures, which in 2011 spun out of technology firm SAP but still relies on that company as its…

SMEs reluctant to list on bourses, notes SEBI

The Securities and Exchange Board of India (SEBI) has expressed concern over small and medium enterprises’ (SMEs’) growing preference for private equity (PE) investment over listing on a stock exchange platform. The markets regulator has introduced an SME platform to help smaller enterprises rais…

SMEs to set a new high in fund raising

The number of Small and Medium Enterprises (SME) raising funds through the SME platform is set to hit a record high in 2016. Already over 30 companies have hit the street in 2016 till date with the BSE accounting for a major chunk of these issues. The BSE SME platform has seen about 25 companies …

IPOs on SME bourse too on a hot streak

The spectacular revival in the primary markets in the last few months is not limited to large IPOs such as Quess Corp or Mahanagar Gas. Public share sales of smaller companies on the dedicated SME boards of stock exchanges, too, have been on a hot streak. All 13 companies that have listed on the …

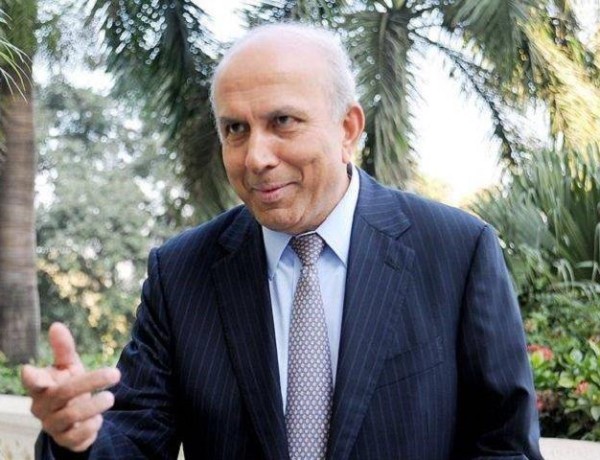

Prem Watsa’s company is on a Quess to achieve 25,000 deliveries

Canadian billionaire Prem Watsa-controlled Quess Corp, which recently entered the logistics business to cash in on the ecommerce boom, is targeting 25,000 deliveries a day. The Bengaluru-based business services provider has set up a logistics arm called Dependo Logistics to serve ecommerce client…

Quality companies & intermediation will be key determinants of a self -sustainable SME exchange | Seema Nayak, Head – NSE Emerge

NSE-EMERGE is a market place promoted by National Stock Exchange (NSE) to bring together investors and emerging SMEs on a common exchange platform. It offers opportunities to investors to invest in emerging businesses while offering capital raising opportunities to credible and fast growing busin…

FICCI, DIPP & IPO come together to commemorate the World Intellectual Property Day 2016

NEW DELHI, 25 April 2016: The Department of Industrial Policy and Promotion (DIPP) has laid down the roadmap for expediting the process of examining the applications of patents, designs and trademarks by appointing additional 458 new examiners and 263 contract examiners at various levels to clear…

Re-imagining SME Fund Raising – The Exchange route!

One of the principal challenges of small & medium enterprises whether in India or anywhere else in the world has perennially been finance. Apart from friends and family, typically MSMEs rely heavily of private money lenders and the unorganised financial markets for their finance needs. Needle…

23 SMEs file IPO papers in Jan-Mar quarter to mop up Rs 200 crore

To tap the upbeat investor sentiments, as many as 23 Small and Medium Enterprises (SMEs) have filed draft papers in the first quarter ending March 31, to raise over Rs 200 crore through their initial public offerings. The shares will be listed on the SME platforms of the BSE and National Stock Ex…