The current government has taken welcome steps to improve the business environment in India. Through Make in India, it also continues to give manufacturing a much-needed push. However, banking on the government for business improvement is not realistic, especially for small and medium enterprises…

Tag: NBFCs

SMEs will tremendously benefit if electronic process continues for some more time: V Vaidyanathan

In an interview to Shilpy Sinha, V Vaidyanathan , chairman of non-banking finance company, Capital First, said Capital First exercises great diligence in lending, but the method of lending is different from traditional ways. Edited excerpts: Q: A large part of your portfolio comprises SMEs, which…

Need to encourage leasing to boost SME growth: World Bank

The World Bank Group sees “leasing” as an important financing tool for Small and Medium Enterprises (SMEs) and wants policymakers in India to take steps to propel its growth in the country. “Leasing is very sensitive to taxation and I understand the taxation rules were changed, and as a result, i…

Need to encourage leasing to boost SME growth, says World Bank official

The World Bank Group sees “leasing” as an important financing tool for Small and Medium Enterprises (SMEs) and wants policymakers in India to take steps to propel its growth in the country. “Leasing is very sensitive to taxation and I understand the taxation rules were changed, and as a result, i…

Small Finance Banks giving competition to old private sector banks, NBFCs

The last year was eventful for the financial services industry; 2017 is expected to surpass that. Over the years we have seen new sectors gaining prominence, be it microfinance, gold finance or small finance banks. Insurance, and in particular general insurance, is the new sector in focus. Over t…

नोटबंदी के बाद MSMEs के लिए लोन और वर्किंग कैपिटल लिमिट बढ़ाई गई | हरिभाई पार्थीभाई चौधरी

केंद्रीय राज्य एमएसएमई मिनिस्टर हरिभाई पार्थीभाई चौधरी ने राज्यसभा द्वारा पूछे गये एक सवाल के लिखित जवाब में कहा है कि सरकार विमुद्रीकरण से एमएसएमई सेक्टर को हुए नुकसान को भरने की निरंतर कोशिश कर रही है। उन्होंने कहा कि एमएसएमई को क्रेडिट गारंटी फंड़ योजना के तहत दिये जाने वाली लोन की सीमा को [&h…

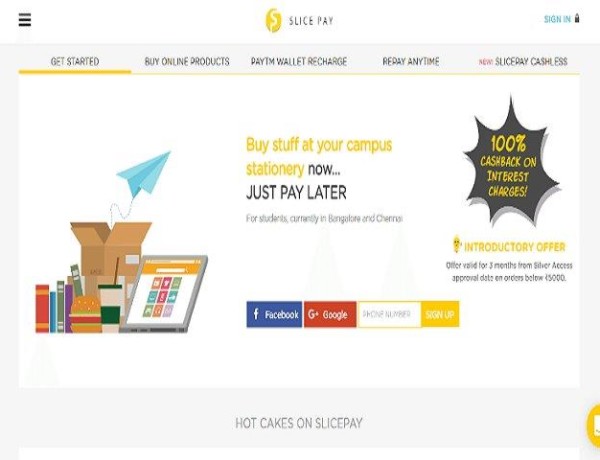

Fintech start-up SlicePay acquires P2P lending platform Trustio

SlicePay, a fintech startup that provides buy-now-pay-later kind of service to its users, has acquired a peer-to-peer lending company Trustio. The deal is said to be an equity deal and as a part of the acquisition, the founders of Trustio will be joining the core team at SlicePay. Launched in 201…

Budget should raise the competitiveness of Indian manufacturing sector

The Indian manufacturing sector has the potential to elevate much of the Indian population above poverty by shifting the majority of the workforce out of low-wage agriculture. Manufacturing sector is the backbone of any economy. It fuels growth, productivity, employment, and strengthens agricultu…

Govt to augment corpus of MSE credit guarantee fund

Government on 18 January approved a package for supporting the micro and small enterprises across the country, which entails augmenting the corpus of Credit Guarantee Trust Fund for such ventures and doubling the coverage of loans under the credit guarantee scheme. The post-facto approval was gra…

MSMEs को मिली सौगात, सरकार ने दी बड़े लोन पैकेज को मंजूरी

सरकार ने सूक्ष्म और लघु उद्यमियों को बढ़ावा देने के उद्देश्य से क्रेडि़ट गारंटी फंड के कोष को बढ़ाने और अपनी क्रेडि़ट गारंटी योजना के तहत दिये जा रहे लोन को दोगुना करने के पैकेज को मंजूरी दे दी है। सरकार द्वारा एमएसएमई सेक्टर को मजबूत बनाने के लिए उठाये गए इस कदम के तहत […]

…