On November 8, Prime Minister Narendra Modi made a televised announcement on the government’s decision to withdraw 500 and 1000 rupee notes that were in circulation in the Indian economy. This huge gamble on notes that accounted for 86% of the value of currency in circulation left a majority of c…

Tag: Paytm

Start-up funding declines, but no let up in deals

India’s start-up ecosystem may have seen a fall in funding this year, but there’s been almost no let-up in the number of deals, highlighting that investor appetite is still strong. Start-ups have attracted roughly $4 billion in funds so far this year, down from a heady $7.55 billion in 2015, whic…

Security double-checked: Paytm to integrate with IndiaStack for UPI

Bengaluru: Paytm will integrate its digital payments services with IndiaStack, an open-stack platform that offers technology infrastructure for the unified payment interface (UPI), esign, digital lockers and electronic customer verification. The Paytm app on December 8 added a new security layer …

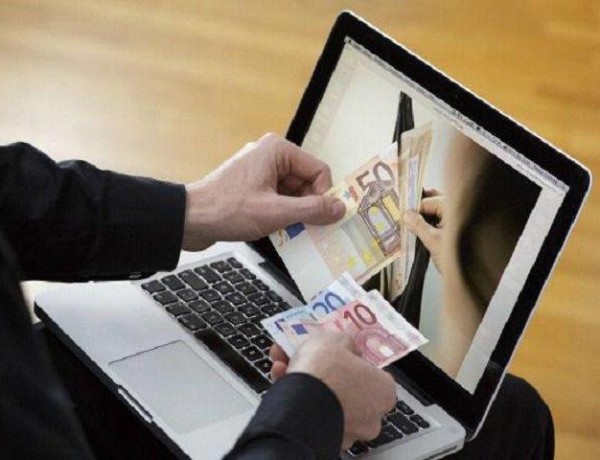

Demonetisation Effect | Claims of business gains for digital payment firms may not be true

It has been a month since the government launched its war on cash, but it is unclear yet if the digital wallet providers have been able to piggyback because of disparate figures that have left the industry flummoxed. While online wallet companies including Paytm, MobiKwik and Free-Charge are decl…

Demonetisation Effect | Big gain for mobile wallets, e-Commerce suffers

Bengaluru/New Delhi: The withdrawal of high-value notes from circulation has had a mixed impact on the country’s online businesses. Sales at e-commerce companies, which are heavily dependent on cash payments, have suffered badly while digital payment start-ups have seen a sharp rise in daily tran…

Venture capital shift from growth to early-stage funding

There are early signs of an uptick in start-up funding but at the same time, venture capital (VC) funding is changing. It is moving from growth stage to early-stage; from consumer to enterprise (b2b), to those offering SAAS (software as a service) or artificial intelligence (AI). Several start-up…

Demonetisation Effect | Hiring may shoot up as Fintech start-ups gain galore

Fintech startups are proving to be the biggest beneficiaries of the government’s demonetisation move and with the rise in business, recruitment plans of these companies are likely to see a significant uptrend in the coming months, experts say. E-wallet companies like Paytm, PayU India, Mobi…

Indian start-up ecosystem lucky to have Ratan Tata’s support: Ola Founder

Mumbai: Amid the corporate war raging within Tata Sons, which has also highlighted Ratan Tata’s work as angel investor in startups after his earlier retirement in 2012, startup founders have come out in strong support of the Tata scion. Ratan Tata-funded cab aggregator Ola founder Bhavish A…

Paytm rolls back small business app on security concerns

Mobile wallet company Paytm has suspended its app that allowed small shopkeepers to accept payment through cards amid ongoing cash crunch, citing risks to customer data and privacy. The new feature was designed to eliminate the need for a physical point-of-sale (PoS) terminal or a card swipe mach…

Currency Switch Impact | How India’s internet commerce industry is coping currency recall

In the two weeks since the government announced its demonetisation initiative, India’s internet commerce industry has scrambled to adjust. Internet entrepreneurs have applauded the move, ostensibly for its long-term payoffs, although online marketplaces and logistics startups have been hit hard b…